Low CIBIL Score Loan: How to Get a Loan Even with Bad Credit

Access to credit has become essential in today’s world – whether it’s to deal with emergencies, manage personal expenses or grow a business. But if you check your credit score and find it further down, you may feel like your doors to financial assistance are completely closed. Thank you very much, but that’s not entirely true.

Now you can get a loan even with a low SIBIL score. It takes the right perspective and awareness on you and your options. Low CIBIL Score loan join it.

What is a CIBIL Score and Why Does It Matter?

If you are eligible for CIBIL and your score is a three digit number, it reflects your creditworthiness, ranging from 300 to 900. Make sure that the higher your score, the higher your chances of getting a loan approved. Generally, a score above 750 is considered good while below 650 is considered ineligible.

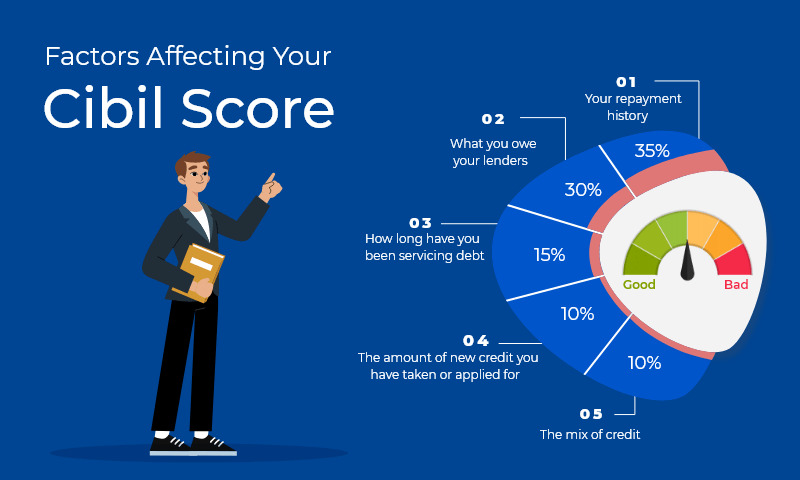

Your score is calculated based on factors like:

- Payment history (whether you pay EMIs and credit card bills on time)

- Credit utilization (how much of your available credit you’re using)

- Length of credit history

- Mix of credit types (credit cards, personal loans, home loans, etc.)

- Recent credit inquiries

The Challenges of a Low CIBIL Score

If you have a low credit score, it doesn’t mean you’re irresponsible. There are many reasons why this could happen, such as someone else missing a payment, being laid off from work, and having no credit history. This can actually make it more difficult to get a loan, which is usually one of the challenges:

- Rejection from banks and mainstream lenders

- Higher interest rates

- Limited loan amounts

- Requirement for a guarantor or collateral

Types of Loans You Can Get with a Low CIBIL Score

While traditional banks might hesitate, there are several other options worth exploring:

1. Secured Loans

In fact, these loans are backed by some kind of asset, for example, gold, fixed deposits or property, so the risk for the lender is low and therefore there may be a higher chance of approving your application even with a low score.

Examples:

- Gold loans

- Loan against property

- Loan against fixed deposit

2. NBFC Personal Loans

Non-Banking Financial Companies (NBFCs) and fintech lenders are often more flexible than banks. They may look at your income and employment stability rather than just your credit score.

3. Peer-to-Peer (P2P) Lending

Online platforms connect you directly with investors willing to lend money. Approval depends more on your income and repayment ability than your credit score.

4. Microfinance and Small Loans

Some microfinance institutions and regional lenders provide small-ticket loans to individuals with poor credit, especially in rural and semi-urban areas.

How to Improve Your Chances of Getting a Loan

If your score is low, lenders need extra reassurance. Here’s how you can boost your chances:

- Add a co-applicant with a good credit score.

- Provide collateral to secure the loan.

- Show stable income through salary slips, bank statements, or ITRs.

- Start small—apply for a lower loan amount.

- Choose flexible lenders such as NBFCs or fintech apps.

Tips to Rebuild Your CIBIL Score

Improving your credit score is not only possible, it’s also smart—because it saves you money on future loans. Here’s how:

- Pay EMIs and credit card bills on time, every time.

- Keep your credit utilization under 30% of your limit.

- Avoid applying for multiple loans or credit cards at once.

- Maintain a mix of credit types (secured and unsecured).

- Check your credit report regularly and dispute any errors.

Lenders That Offer Loans to People with Low CIBIL Scores

Several NBFCs and fintech platforms offer loans with relaxed CIBIL score requirements. Some names include:

- MoneyTap

- Bajaj Finserv

- CASHe

- EarlySalary

- PaySense

- StashFin

Be Cautious of Predatory Lenders

When you’re desperate for a loan, it’s easy to fall into traps. Here are some red flags to watch out for:

- Lenders that ask for upfront fees without clear terms

- Unrealistically low interest rates

- No physical address or customer support

- “Guaranteed approval” claims

Stay informed and read every loan agreement carefully before signing.

Conclusion

If your CIBIL score is low, it can make it more difficult to get a loan, but not impossible, with the right strategy, borrowers can get the financial help they need without falling into the trap of borrowing, with a desire to find alternative lenders.

Remember, your credit score doesn’t define your future—it just guides your path. Start small, borrow smart, and build a better financial tomorrow.

FAQs

Q1: Can I get a loan with a CIBIL score of 500?

Yes, but your options will likely be limited to secured loans or NBFCs that consider income and job stability over credit score.

Q2: What is the minimum CIBIL score needed for a personal loan?

Most banks prefer a score of 750+, but some NBFCs may approve loans with scores as low as 600 or even lower with additional conditions.

Q3: Will applying for a loan hurt my CIBIL score further?

Each application leads to a hard inquiry, which may slightly lower your score. Avoid applying to multiple lenders at once.